Payroll is more than just paying employees their monthly wage. It's a comprehensive system that manages everything from salary calculations to tax deductions and benefits administration. In today’s fast-paced business world, payroll has evolved into a digital process that ensures accuracy, transparency, and compliance with labor laws.

When you hear the term payroll, you might immediately think of salaries, but there's much more to it than just transferring money into employees’ bank accounts.

So, what is payroll exactly?

What is Payroll

Payroll refers to the system a company uses to calculate and distribute salaries to its employees on a regular basis, typically weekly or monthly. In the past, this process was often manual and time-consuming. Today, thanks to modern payroll applications, HR departments can manage the process faster, more accurately, and with greater transparency.

Payroll doesn’t just involve basic salary payments. It also includes overtime, bonuses, tax deductions, health and social insurance (like BPJS), and other allowances. This makes payroll a critical component of both HR and finance departments.

Why Payroll Software Matters: Benefits of a Modern Payroll System

Implementing a robust payroll application brings a host of advantages that go far beyond simple salary disbursement. Here are some of the most impactful benefits:

1. Transparent Salary Breakdown

A digital payroll system ensures each employee receives a clear, itemized breakdown of their pay. This includes bonuses, tax deductions, insurance contributions, and allowances. Many systems also email payslips directly to employees, making it more convenient and accessible.

2. Saves Time and Reduces Manual Work

Manual payroll processing is not only tedious but also prone to error. Payroll applications automate most of the process, including syncing with attendance records, saving HR and finance teams a significant amount of time and effort.

3. More Accurate Calculations

Mistakes in payroll can lead to dissatisfaction or even legal issues. Payroll software minimizes these risks by accurately calculating salaries, deductions, taxes, and reimbursements in line with company policies.

4. Simplified Tax Management

Payroll systems can automatically generate employee tax reports, making it easier for businesses to stay compliant with tax regulations. This saves time and reduces the chances of human error in reporting.

5. Secure and Organized Data

Digital payroll systems store all employee compensation records securely. This reduces the need for physical paperwork and ensures data is well-organized and easy to access when needed.

6. Streamlined Financial Reporting

Payroll data plays a crucial role in overall company accounting. A good system can generate detailed reports to help management analyze labor costs and make informed financial decisions.

How Does the Payroll Process Work?

Payroll is more than just hitting “send". A well-structured payroll system follows a clear, multi-stage workflow: It involves several key stages:

1. Pre-Payroll

Before calculations begin, the company sets internal policies such as tax deductions, bonuses, and insurance. HR then gathers data like attendance records and salary adjustments. This information is standardized into the payroll system.

2. Payroll Calculation

The system computes each employee's salary based on their base pay, overtime, taxes, and benefits. After validation, the final amount is approved for transfer to employee accounts.

3. Post-Payroll

The final stage includes updating company financial records and preparing official reports. HR teams work with finance to ensure all transactions are documented. Payslips are distributed, and taxes are filed accordingly.

Common Payroll Calculation Methods

Depending on company policy and legal requirements, businesses may choose from different payroll calculation methods:

1. Net Pay Method

Employees receive their net salary after all statutory deductions, such as taxes and insurance. The employer handles all compliance-related tasks, making this method the most common and employee-friendly.

2. Gross Pay Method

Employees are paid their gross salary without any deductions. They are responsible for calculating and paying their own taxes and social contributions. This method is less common and typically used in specific contractual arrangements.

3. Gross-Up Method

A hybrid approach where the company pays the employee’s full salary plus an additional amount to cover taxes. The result? The employee receives their full take-home pay without worrying about tax deductions.

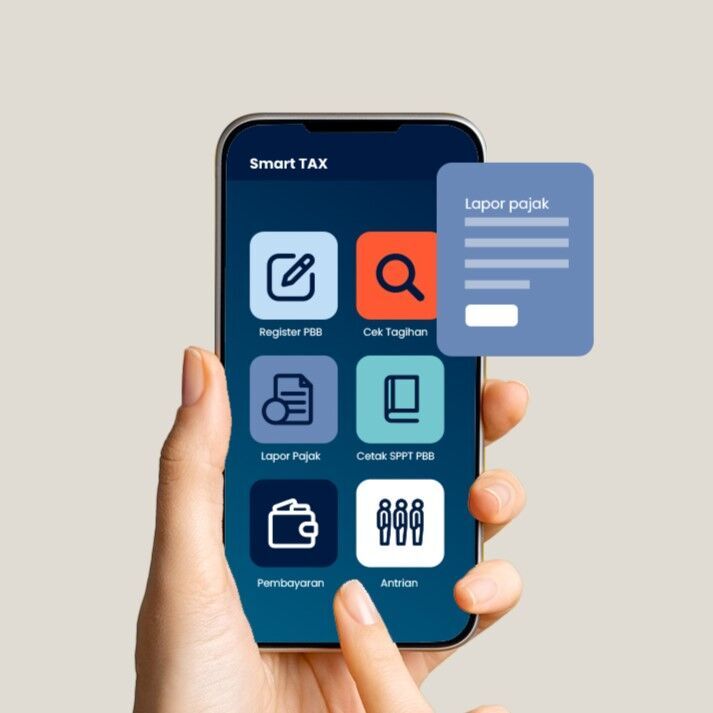

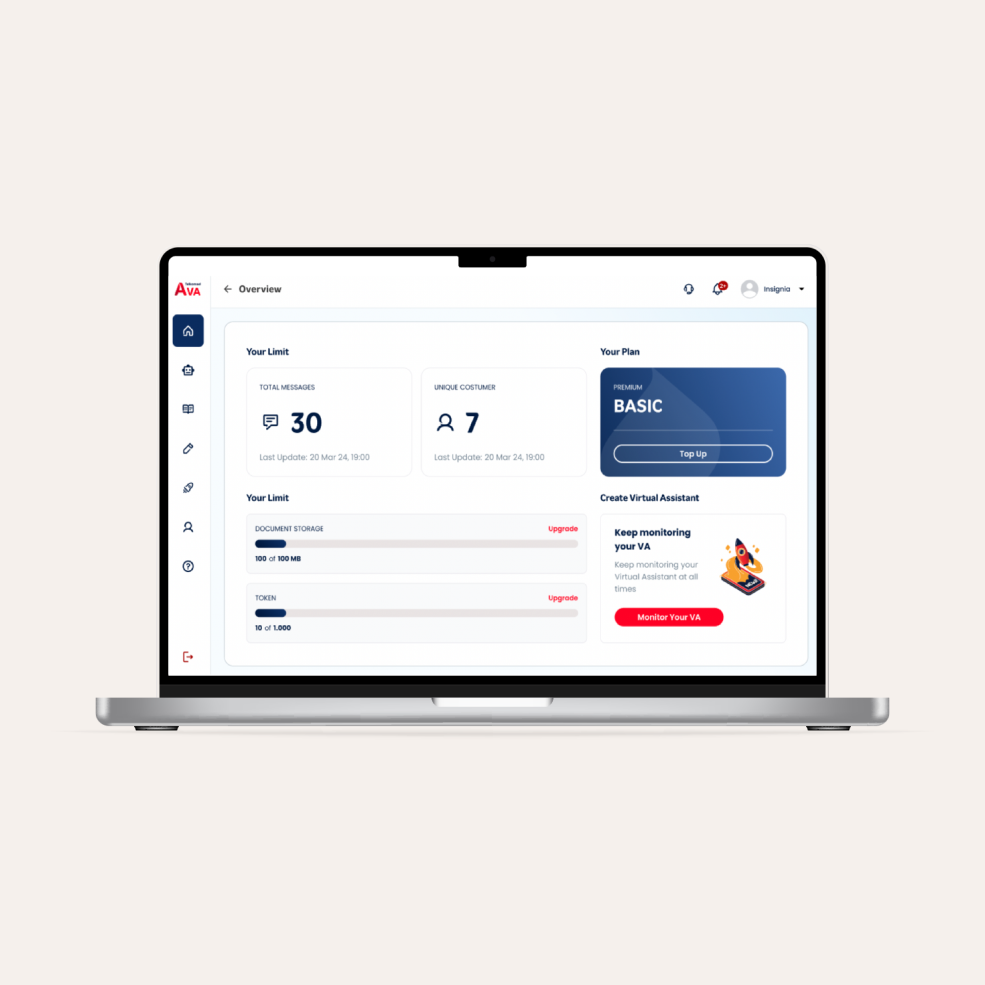

Modernize Payroll with Human Resource Apps

Managing payroll manually is not only inefficient but also risky. That’s where. Human Resource Apps come in integrated platforms designed to handle everything from attendance tracking to salary disbursement.

Telkomsel Enterprise offers a powerful HR app solution that streamlines payroll operations while ensuring accuracy, compliance, and ease of use. From leave management to automated payslip generation, our platform empowers HR teams to focus on strategic initiatives instead of administrative burdens.

Ready to transform your payroll process? Contact us today to learn how Telkomsel Enterprise’s Human Resource App can revolutionize your payroll management and drive operational excellence.